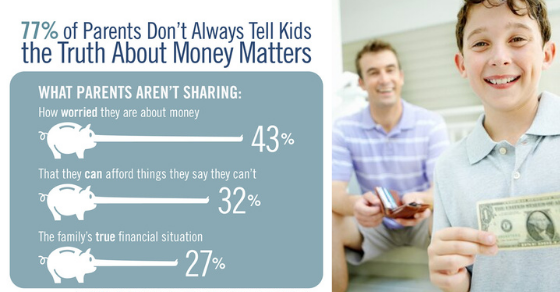

Growing up we all didn’t have perfect work and finance examples from our parents. Some of our parents had limiting beliefs and ideas about money, their career, and how their finances played out. Many of us were influenced by our parents beliefs and ideas and those played out in our lives as we started and developed in our careers and finances.

I think that for the most part we can all somewhat agree that the job market and the economy in general were a LOT different when our parents were growing up. They could pay there way through college while working quite easily. They also got actual interest on their bank account that was close to or matched inflation, now we cannot even get .33% from our careless banks!

Times have definitely changed in the world of finance and careers, but unfortunately, not all parents see that for what it is — and because of that their kids may have been subjected to some advice about work and money that isn’t as accurate as it once was.

People were surveyed and asked what their parents told them about their career and money and how that impacted them and their perspective. This is what they shared!

“Just try to stick with the company for a while longer, it will get better.”

“My father said this after I told him I was struggling to eat and sleep due to the stress a previous job was causing me. Mind you, he has not worked since the early 2000s and at Enron! I am much happier now that I left that company and the construction industry altogether.”

—sarahrichman94

“Just hand them your résumé.”

“I am in the process of trying to find a new corporate job, and my parents just DO NOT understand that you can’t hand the person at the front desk of a Fortune 500 company a résumé. Most jobs require an online application that is typically screened and reviewed by a robot, and if you fail to include a key word (which they don’t tell you), human eyes will most likely never even see it.”

—emailemailemail123

3.”You know music is not a practical career.”

“I detoured 10 years in a major and jobs that my mom wanted me to have and I hated. Then I went back to school for music and have been working as a professional musician ever since. I lost 10 really good years believing her that I wasn’t good enough at what I knew in my bones I could do. Also, my dad told me not to do credit checks because it would ding my credit. Found out later that he didn’t want me to check my credit because he had stolen my Social Security number and identity and taken multiple lines of credit out in my name to support his addictions. Yeah, he’s a total POS. Still climbing back from that one.” —altenbas

4.”You should have X amount saved by 30, 35, 40 years old…”

“For some reason, my father seems to hold that more strictly for my middle brother, but to this day, he’s still overly interested in the status of my two brothers’ and my bank accounts. In his eyes, we’ve failed as adults if we don’t have a specific (but random) amount of money saved, not taking into account inflation, lifestyle/career choices, etc.”

—TrilingualMom

5.“A penny saved is a penny earned.”

“Yeah, sure, but a penny won’t help you buy a house or take out a mortgage.”

—sup_guys

6.”Keep calling to show you’re interested!”

“When I was applying for jobs when I was just out of school, they said, ‘Keep calling to show you’re interested!’ or ‘Keep applying to the same place!’ No. That just pisses people off. Put in your application and wait, like everyone else.”

—kzich84

7.“Get a real job.”

“If I had a nickel for every time my boomer parents told me this, I’d be a rich woman. I’ve been on my own since I moved out after college and have had long-term creative and/or management jobs. To them, if I am not working in an office in a suit from the petites section at the department store, then it is not a “real” job. I’m 47 and my dad literally texted me on April 15 to remind me to do my taxes, as if I had not already done them, or forgot, or have ever forgotten. I appreciate their love and concern, but they are very out of touch with modern things, and it is so stifling! They are not creative or flexible.”

—peashootbiscuit

8.“Consider moving to another state to make more money.”

“I live and work in a seasonal town, and during a slow time, my uncle told me this, as if moving is just a cheap, easy solution.”

—mandyl10

9.”No one will hire you with that tattoo.”

“When I got my first tattoo, my dad told me absolutely NO ONE would hire me (even though I told him that my tattoo is on my ankle, where I could easily cover it with long pants or skirts, and it is the size of a ping-pong ball). Ten years later and with an additional tattoo (on my arm), I am working as a teacher at an early education center.”

—aries97

10. “What’s yours is hers, and vice versa.”

“My father-in-law told me and my husband to get rid of our separate bank accounts and combine it all together. No thanks. We split bills, but I will keep my own account.”

—meagann4eb9b8d5b

11.“You don’t need money to have kids.”

“I grew up paycheck to paycheck. I’m making sure I have plenty of money before I start having kids. They deserve the best I can give.”

—SJ

12.”It’s good to be busy.”

“My mom asks how work is and I say, ‘Very busy.’ She replies, ‘Well, it’s good to be busy’! No, Mom, I’m doing the work of three people and I feel like I’m drowning because my boss refuses to hire more help.”

—morgank43d4975b8

It’s no secret that money, your finances at any given time and your career are very important. Sometimes we align with our parents beliefs around money and our career and sometimes we do not. Sometimes their model for how this works for us, sometimes it doesn’t. Sometimes, oftentimes, we can take the good and leave the bad. Perhaps your parents were very scarcity minded and you work very hard and have that same frugal mindset, you can lighten up a bit.

Perhaps your parents were very loose with money and always chasing the next paycheck. Whatever the case is, find your own flow and rhythm. Just remember that needs always come before wants. Meet your needs first. Your housing, food, baseline bills, and then what’s left over you can ‘play with’ more.

Once your bills are met, and basic needs are covered what you do with it beyond there is really up to you. Spend some and have fun, but invest some of that money for your future as well. Money isn’t all about today, but it isn’t all about tomorrow either.

Recommended Reading: 10 At Home Businesses That Will Make More Money in 2022.